A Step-by-Step Introduction to Ledgers in Accounting

Ledgers help track all your financial transactions. This guide breaks down how they work and why they matter in bookkeeping.

Ledgers help track all your financial transactions. This guide breaks down how they work and why they matter in bookkeeping.

The purpose of general ledger accounting is to create a full record of a business’s transactions, which a business can use to prepare its financial statements. The information included in an accounting ledger includes:

The general ledger also contains a chart of accounts, which contains the account names and numbers for categories such as:

Making an accounting ledger is fairly straightforward. To create and format a general ledger to accurately track your business’s financial situation, follow these four steps:

The five main types of accounts are assets, liabilities, equity, revenue, and expenses.

Use double-entry ledgers with separate debit and credit sides, each showing date, description, folio number, and amount.

Record each transaction in its respective ledger, then consolidate all entries into the general ledger at the end of the period.

A trial balance lists all debits and credits from the general ledger, and if both sides are equal, your books are balanced.

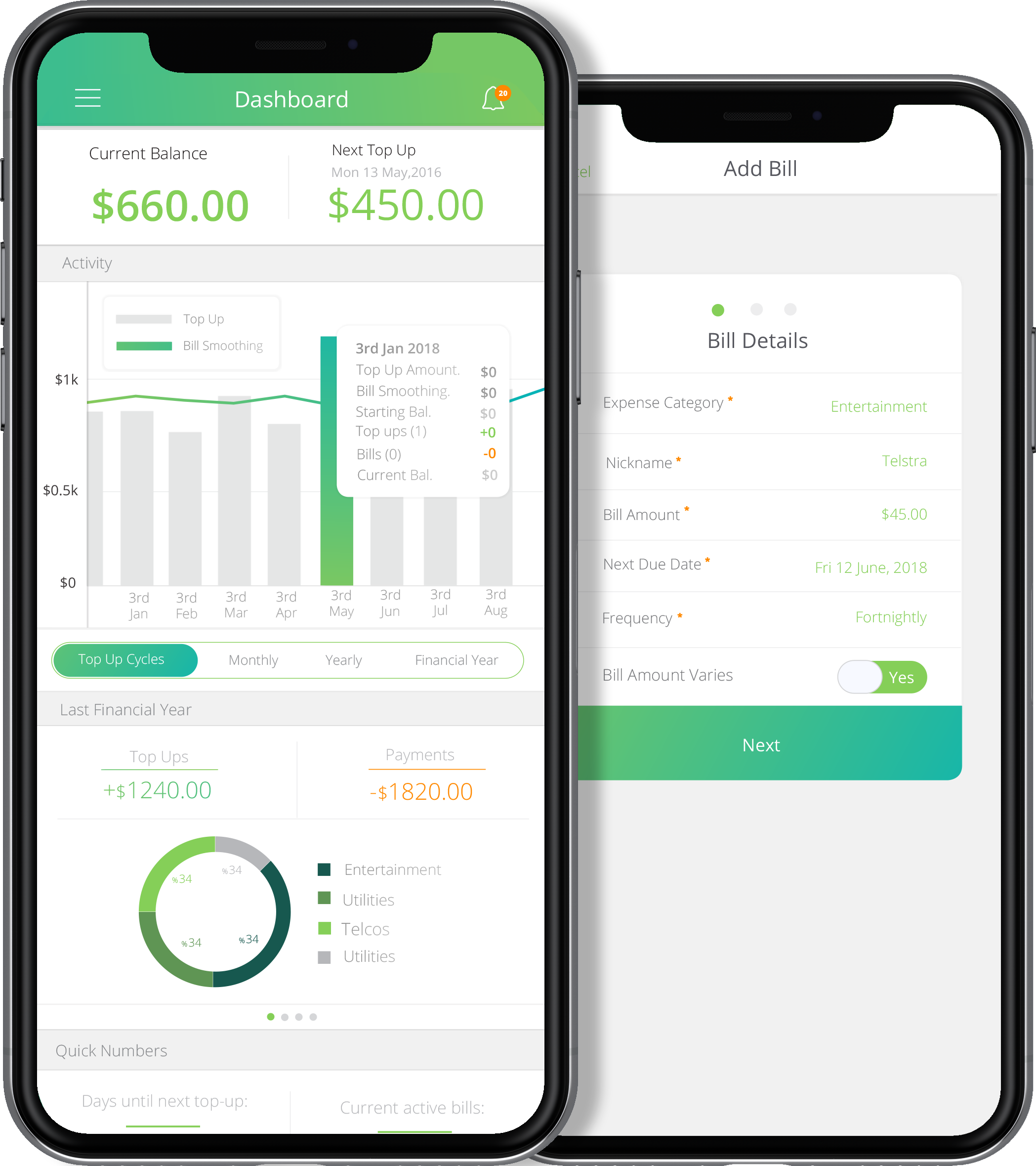

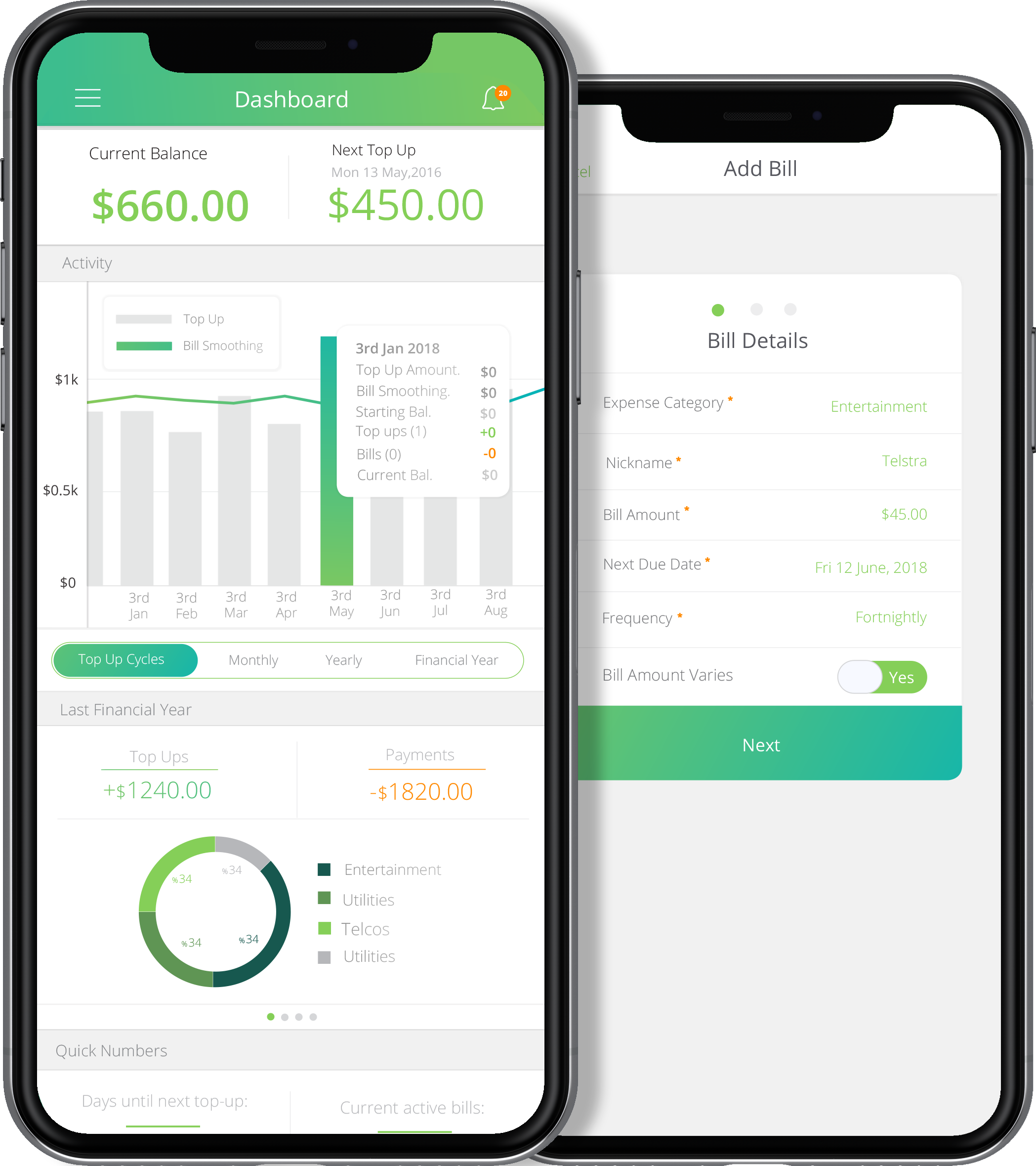

Your purchase ledger helps track all items your business buys. If purchases are minimal, you can record them in the general ledger instead.

A sales ledger is a detailed list in chronological order of all sales made. This ledger is often also used to keep track of items that reduce the number of total sales, such as returns and outstanding amounts still owed.

A general ledger is a complete record of all financial transactions over the life of your business.

No, a trial balance is a report that lists the balances of all ledger accounts to check accuracy, while a ledger is where transactions are recorded.

Yes, keeping both helps track what you buy and sell, giving you better financial insights and accuracy.